A high-ranking official at Raine Group, who engineered Sir Jim Ratcliffe’s part-takeover last year, has explained why the likes of Manchester United are still a dream investment.

As anyone who works in mergers and acquisitions will tell you, these kinds of transactions aren’t as simple as writing the biggest number on a piece of paper.

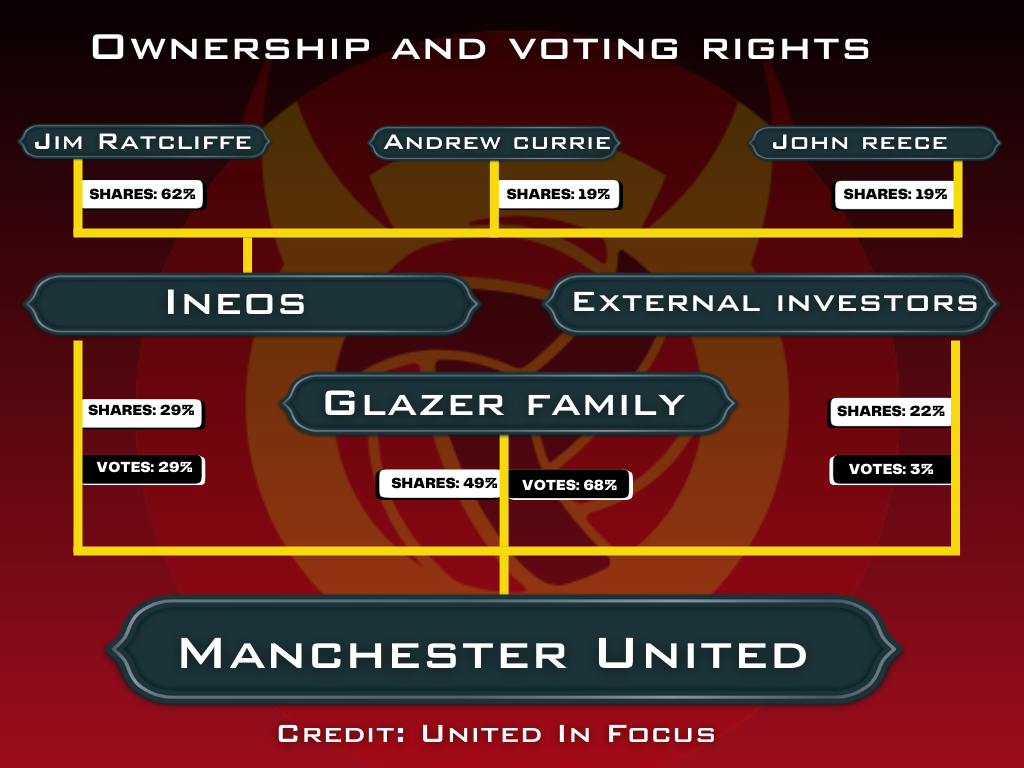

United eventually concluded a deal which saw Ineos agree to acquire 29 per cent of the club’s equity for £1.25bn last February, well over a year after the Glazers initially announced that the club was for sale.

In that period, endless pitch decks were prepared, a PR war was fought, banks and private credit firms haggled for the right to underwrite a deal, and a thousand proposed structures came and went.

Managing that process, pulling together stakeholders in Manchester, Florida, New York and beyond, was Raine Group, the advisory group that has become the go-to broker for blue-chip sports takeovers.

Clearly, it has not been smooth sailing in the 18 months since Sir Jim Ratcliffe pitched up in M16.

While simultaneously fighting a number of issues in his wider business empire, Ratcliffe has 1) made hundreds of job cuts, 2) become a Scrooge-like figure in the British press, 3) planned to knock down Old Trafford and build a new stadium, 4) fired one unpopular manager and replaced him with another, 5) overseen a wider executive overhaul, 6) presided over United’s worst season in 50 years.

And yet, doyens of football finance industry like Raine Group are still bullish about the 73-year-old’s investment.

Man United are still strongest commercial force European sport, says Raine Group

When United joined the star-crossed European Super League in April 2021, it was no coincidence that the proposed format was eerily similar to that of the NFL.

Unlike with the Red Devils, the Glazer family’s investment in the Tampa Bay Buccaneers is a cash machine.

Why? Because of the franchise system in which they operated. Spending is capped, certain revenues guaranteed and profits nailed on, each and every single season.

The sophistication of US sport’s commercial strategy is also the envy of institutions like the Premier League.

However, Raine Group partner Jason Schretter, who was instrumental in the Ineos part-takeover, insists that United are the best of the bunch when it comes to replicating that appeal on this side of the pond.

Speaking to City AM, Schretter compared business in industries like tech to sports teams, likening United’s brand to that of the LA Lakers, the NBA team who were recently sold in a world-record deal and kyboshing the myth about United’s commercial fall-off in the process.

“10-20 years from now, is Google going to be Google? Is Facebook going to be Facebook? Whatever – maybe, maybe not. Are the LA Lakers going to be playing basketball? Yes.

“Manchester United might be the farthest along of any non-US franchise [commercially]. Look at the gap between Manchester United and other teams in Europe, and in terms of how they engage fans globally, it’s just a different story.

“There’s a real tailwind, and that is the monetisation of sports IP in all aspects of life, so all these things that are engaging fans and what that does to the profile of players, teams, leagues.

“Formula 1 started it with Drive To Survive and people followed that. There’s been an improvement in merchandising and premium experiences – all these things are really exciting in terms of what that brings.”

- Follow GRV Media’s Head of Football Finance and Governance Content @Adam___Williams on X for all the latest Man United business news and analysis.

Exclusive: United’s commercial downturn is overstated, says Kieran Maguire

United filed their final quarterly report for 2024-25 this week, swiftly followed by their full audited financial statements for the season.

Despite generating a loss of £33m, the response has been broadly positive.

Despite a fall-off in TV income due to a lack of Champions League football, turnover hit a new high of £667m. The club also set records for commercial and matchday income.

| Metric | 2025 result | 2024 result | Change |

| Commercial revenue | £333.3m | £302.9m | +10.0% |

| Broadcasting revenue | £172.9m | £221.8m | -22.0% |

| Matchday revenue | £160.3m | £137.1m | +16.9% |

| Total revenue | £666.5m | £661.8m | +0.7% |

| Adjusted EBITDA | £182.8m | £147.7m | +23.8% |

| Operating loss | -£18.4m | -£69.3m | 73.4% improvement |

| Net loss | -£33.0m | -£113.2m | 70.8% improvement |

| Basic loss per share | -19.32p | -68.44p | 71.8% improvement |

| Adjusted net loss | -£17.5m | -£55.1m | 68.2% improvement |

| Adjusted basic loss per share | -10.24p | -33.32p | 69.3% improvement |

| Non-current borrowings (USD) | $650.0m | $650.0m | 0.0% |

Perhaps most encouragingly of all, United have forecasted minimum revenues of £630m for 2025-26 despite no European football of any description, as well as an early exit from the League Cup.

“They are still Manchester United,” says Liverpool University football finance lecturer Kieran Maguire in exclusive conversation with United in Focus, lauding the club’s commercial resilience.

“Liverpool went 30 years without winning the title but they continued to be one of the top two or three commercial positions because of the legacy impact.

“United owe a huge debt to Sir Alex Ferguson and David Gill for creating that dominance for the first 15-20 years of the Premier League at a time when the product was going out into the international markets for the first time.

“In 1992, the Premier League gave away the international rights for free in certain markets and Man United won the Premier League most of the time.

“Sponsors want to be associated with success, and Man United were the most successful club. That built up a hardcore, international fanbase. That is the nature of football fandom.

“Some commentators are saying the TikTok generation are more interested in star players than individual clubs, but I don’t see the evidence for that. United are still a global club in that respect.

“The half-life of that kind of support is the same as uranium. It’s very, very long. They benefited from that first-mover advantage because of their early dominance in the Premier League and they are still dining out on that.”

from United In Focus https://ift.tt/gEwmP2F